Ben Constable-Maxwell

Head of Sustainable and Impact Investing, M&G

Impact investing is becoming increasingly popular. It could play a part in helping the world meet the UN Sustainable Development Goals — while aiming to deliver good financial returns.

Impact investing used to be something of a niche financial activity, but it’s become increasingly popular in recent years, notes Ben Constable-Maxwell, Head of Sustainable and Impact Investing at M&G. In fact, these days, the question isn’t: ‘Why would I become an impact investor?’ It’s: ‘Why wouldn’t I?’

“People realise they can drive positive change — and hope to generate good financial returns — by investing in companies and projects that are tackling the world’s most pressing social, environmental and economic challenges,” says Constable-Maxwell.

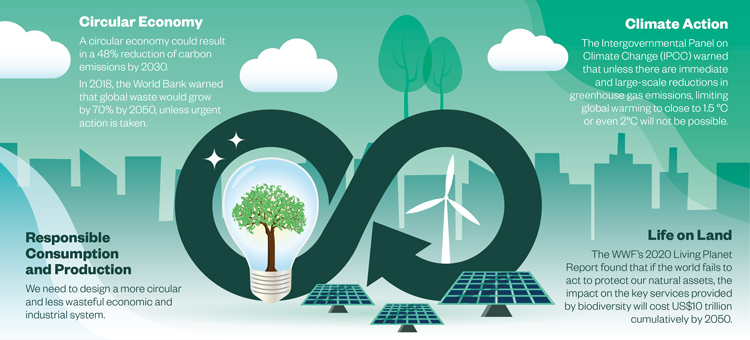

That’s just as well, because — as COP26 reminded us — there are worryingly huge issues to solve. In 2015, the UN outlined 17 Sustainable Development Goals (SDGs) which it described as “a blueprint to achieve a better and more sustainable future for all.” However, a 2020 M&G report, called The SDG Reckoning, makes sobering reading because it stresses that much more needs to be done if the world is to meet the SDGs and their underlying targets.

Investment opportunities offered by the circular economy

In this regard, there are many areas where impact investors could help, says Constable-Maxwell. Take the circular economy, which is the idea of designing out waste in the production process by using it as a resource. “This offers lots of potential opportunities for investors,” he reveals. We’ve recently made an investment in a firm which takes mixed plastic and recycles it into food grade plastic. The principles of the circular economy can be applied across all sectors.”

People realise they can drive positive change — and hope to generate good financial returns — by investing in companies and projects that are tackling the world’s most pressing social, environmental and economic challenges.

The SDGs also highlight the importance of protecting nature and stopping biodiversity loss. Yet this is a relatively early-stage area for many impact investors — so which assets should they be focusing on here? Constable-Maxwell has various suggestions including sustainable forestry, sustainable food and agriculture, and firms working on technology to make agricultural processes more efficient and less wasteful.

The shift towards impact investing is a reason for optimism

Climate adaptation and resilience can be difficult terrain for impact investors in a listed market context. But in private markets there are potential opportunities to invest in, say, regenerative and sustainable agriculture, the insurance industry (which has a big role to play in insuring companies, industries, homes and people against the effects of the climate crisis) and even those producing early warning systems for floods and weather events.

Impact investing does have its limitations. It’s not always easy to measure the impact that this type of investment can have, although better analysis tools and tech are being produced. “Also, the environmental and social domain shouldn’t become purely the responsibility of investors,” says Constable-Maxwell. “Governments and civil society also need to play their part. Even so, it’s been gratifying to see a huge shift towards impact investing, and that it’s proving its worth. In my opinion, that’s a big reason for optimism.”

The views expressed in this document should not be taken as a recommendation, advice or forecast.

We are unable to give financial advice. If you are unsure about the suitability of your investment, speak to your financial adviser.

This financial promotion is issued by M&G Securities Limited which is authorised and regulated by the Financial Conduct Authority in the UK and provides ISAs and other investment products. The company’s registered office is 10 Fenchurch Avenue, London EC3M 5AG. Registered in England and Wales. Registered Number 90776.

While we support the UN SDGs, we are not associated with the UN and our funds are not endorsed by them.