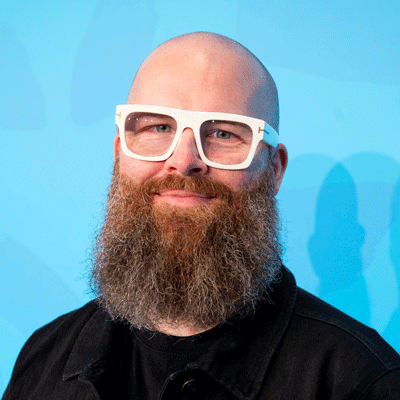

Stuart Miller

Director of Industry Engagement, Xero UK

Small businesses across the UK are urged to speed up digital adoption to help them become more efficient and tackle key issues, such as cash flow and late payments.

While adopting digital tools can help small businesses better manage cash flow and expenditure, and potentially reduce the scourge of late payments, uptake remains slow.

Software boosts efficiency

Stuart Miller, Director of Product Compliance and Industry Engagement at Xero says software solutions can add greater transparency to a company’s financial accounts on a day-to-day basis, offering real-time data of cash flow and simplifying manual processes. He underlines the value of open banking-driven tools, like bank feeds, providing a digital link between a small business’s bank account and its accounting software.

“The tech now available to businesses means they can benefit from having real-time data to make better-informed decisions about how to run their businesses,” he says. With high inflation and the cost of living crisis, he believes it is more important than ever for firms to better understand their figures so they can navigate these tricky waters.

Digital tools like accounting software enable firms to see who owes money and better plan for the future — whether for investment, loans or buying fresh stock from a wholesaler. Having financial data instantly through an app means they can make informed, on-the-spot decisions and better collaborate with their accountant or bookkeeper.

Open banking and financial transparency

With the UK undergoing a digital transformation, Miller urges small companies to start realising the value of cloud technology and open banking before it becomes mandatory, pointing to HMRC’s ‘Making Tax Digital’ programme to improve tax digitisation.

Via open banking, business owners can automatically update their banking on the go through cash coding, such as when they refuel, with petrol receipts going directly to their petrol code account. Profit and loss reports are also readily available.

“These tools are minimising the amount of time small businesses and their accountants have to spend on things like bank reconciliation — reducing administrative burden and giving them more time to focus on running and growing their business,” he adds.

While businesses using digital tools are thriving,

there are huge numbers of businesses in

the UK that are digitally averse.

Digitised businesses getting ahead

However, he remains concerned that digital adoption is slow, with many smaller businesses left behind. Xero’s report, ‘Beating the digital drag’, found that SMEs that digitalised saw revenue grow by 8.1%, compared to slower adopters.

Around 40% of the UK’s smallest businesses (zero to nine employees) report using emerging technologies, such as AI and digital assistants, compared to 77% of larger SMEs; and 4 out of 10 of the smallest businesses say they fail to see the relevance of new technologies. Miller says: “While businesses using digital tools are thriving, there are huge numbers of businesses in the UK that are digitally averse. We need to close that gap.”

Cash flow control and e-invoicing

Efficiencies outweigh the cost of investment in the software, which is an allowable tax expense, explains Miller. “Those not digitising struggle when it comes to late payments as they cannot see who has paid and what is outstanding. They are never going to be able to keep on top of cash flow,” he continues. “That causes fiscal worries and can affect wellbeing and a business owner’s mental health, too.”

Xero’s recent Money Matters report showed that 72% of small businesses experience cash flow issues, but a quarter still prefer to manage payments using traditional methods (26%). Paying bills is crucial for cash flow; open banking tools like bill payments mean small businesses can pay bills with the click of a button — avoiding manual bank transfers or entering credit card details. E-invoicing is also emerging as a faster way to send and receive invoices, removing the need for paper or PDF invoices.

Miller believes tools like these can help address late payments, boost cash flow and improve productivity. “It is allowing businesses to realise their full potential through technology,” he says.

Xero provides cloud-based accounting software for small businesses. For more information on how digital tools can help you better manage cash flow, visit the Xero cash flow hub here.